Qiro Marketplace

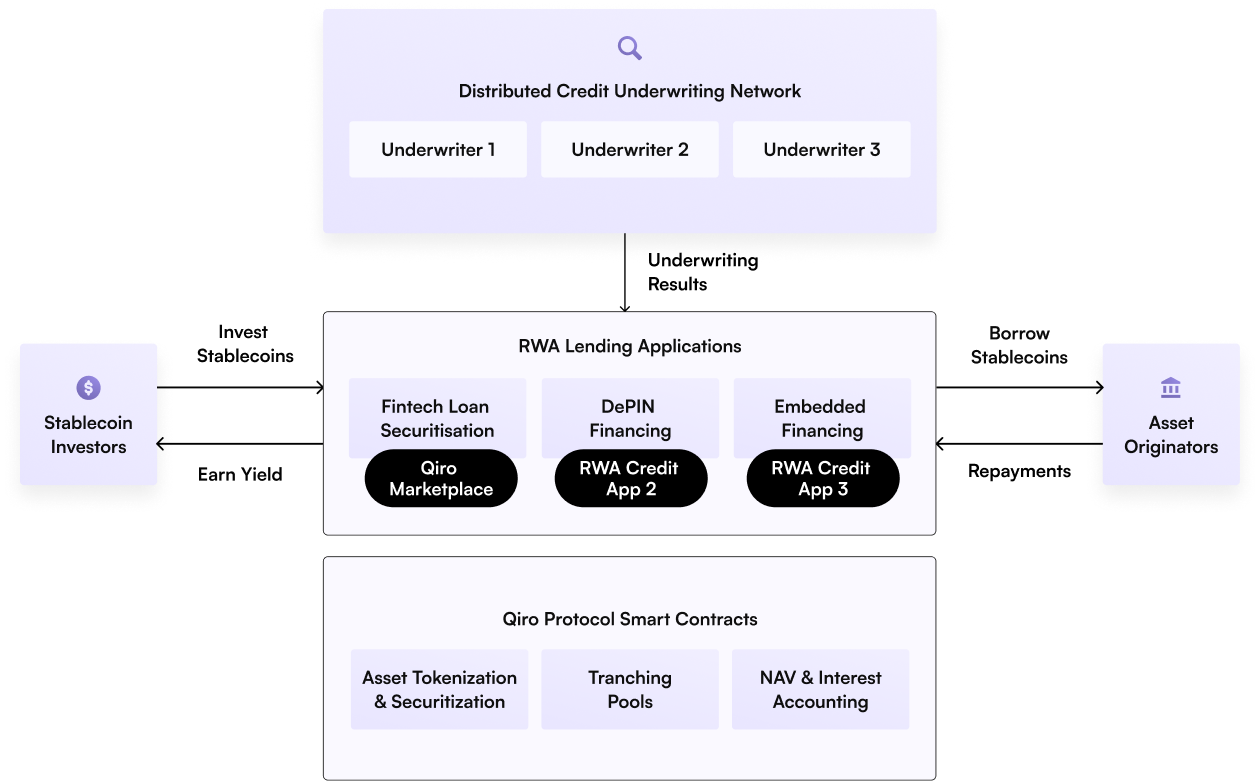

High level overview of Qiro Finance

Qiro is developing a decentralised private credit protocol with the capability to facilitate a wide range of tokenised private credit . This is achieved by unifying asset originators, stablecoin investors, and credit underwriters under a single framework.

Our protocol supports two primary types of credit products:

1. Term Loan Pools

Designed for fixed-tenure lending, Term Loan Pools follow a predictable repayment structure. These pools typically involve regular principal and interest repayments over time and may optionally support tranching. They are well-suited for straightforward lending arrangements with predefined cashflows. These pools will be focused on funding non-lending fintechs which are in payments, invoicing, real estate domain. Read more here: Term Loans

2. Securitisation Pools

Built for more dynamic, cashflow-based repayment scenarios, Securitisation Pools allow investors to participate in structured finance deals with multiple tranches (e.g., Senior and Junior). Instead of scheduled repayments, these pools distribute actual cashflows from the underlying assets based on predefined waterfall mechanisms. These pools will be focused on funding lending fintechs which are in invoice financing/discounting, trade finance, gold loans, consumer loans. Read more here: Securitisation

Last updated